KSS PRASAD INCOME TAX SOFTWARE FY 2023-24 AY 2024-25 LATEST VERSION 2024 DOWNLOAD

KSS PRASAD INCOME TAX SOFTWARE FY 2023-24 AY 2024-25 LATEST VERSION 2024 DOWNLOAD click here

Budget 2023: Know the Old & Latest Income Tax Slab Rates

Just one thing that now the salaried class looks forward to when it comes to the budget is the income tax incentive. When delivering Budget 2023 on 1 February 2023, Finance Minister Nirmala Sitharaman adjusted the slabs to offer some relief to the middle class.

During the presentation of Budget 2020, FM Sitharaman said that “It is proposed to increase the rebate for the resident individual under the new regime so that they do not pay tax if their total income is up to ₹7 lacks.”

Income Tax OLD Slabs for Individuals and HUF

Tax Slabs |

Age Less than 60 years |

Age 60 years to 80 years |

Age More than 80 years |

Up to Rs. 2,50,000 |

Nil |

Nil |

Nil |

Rs. 2,50,001 to Rs. 3,00,000 |

5% (Tax rebate u/s 87A) |

Nil |

Nil |

Rs. 3,00,001 to Rs. 5,00,000 |

|

5% (Tax rebate u/s 87A) |

Nil |

Rs. 5,00,001 to Rs. 10,00,000 |

20% |

20% |

20% |

Above Rs. 10,00,000 |

30% |

30% |

30% |

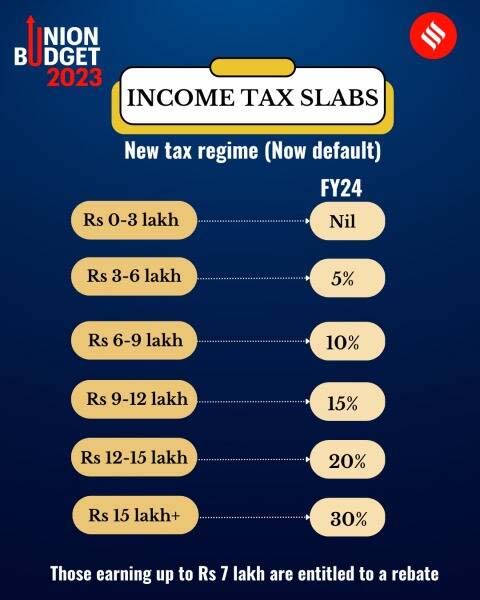

New Tax Regime

The new tax regime has common tax rates for every individual and HUF taxpayer, unlike the old regime which differentiates taxpayers on the basis of their age. This regime was revamped in the Union Budget 2023. The new tax regime for FY 2023-24 is given below.

Tax Slabs |

Income Tax Rates |

Up to Rs. 3,00,000 |

Nil |

Rs. 3,00,001 - Rs.6,00,000 |

5% (tax rebate under section 87A) |

Rs. 6,00,001 - Rs. 9,00,000 |

10% (tax rebate under section 87A below Rs. 7 lakh) |

Rs.9,00,001 - Rs.12,00,000 |

15% |

Rs. 12,00,001 - Rs.15,00,000 |

20% |

Above Rs. 15,00,000 |

30% |

Budget 2023: New Income Tax Slab Rates

New Income Tax Slab Rates

- No tax will be charged on income up to 3 lakh rupees.

- Income between 3-6 lakh rupees would indeed be taxed at 5%.

- Income between 6 and 9 lakh rupees would indeed be taxed at 10%.

- Income between 9 and 12 lacks at 15%

- Earnings of 12-15 lakh at a 20% tax rate

- Income of 15 lacks or over will also be taxed at 30%.

Conditions for opting new tax regime

The taxpayer

opting for concessional rates in the New Tax regime will have to forgo

certain exemptions and deductions available in the existing old tax

regime. In all there are 70 deductions & exemptions that are not

allowed, out of which the most commonly used are listed below:

| Particulars | Old Tax Regime | New Tax regime (until 31st March 2023) | New Tax Regime (From 1st April 2023) |

| Income level for rebate eligibility | ₹ 5 lakhs | ₹ 5 lakhs | ₹ 7 lakhs |

| Standard Deduction | ₹ 50,000 | – | ₹ 50,000 |

| Effective Tax-Free Salary income | ₹ 5.5 lakhs | ₹ 5 lakhs | ₹ 7.5 lakhs |

| Rebate u/s 87A | 12,500 | 12,500 | 25,000 |

| HRA Exemption | ✓ | X | X |

| Leave Travel Allowance (LTA) | ✓ | X | X |

| Other allowances including food allowance of Rs 50/meal subject to 2 meals a day | ✓ | X | X |

| Standard Deduction (Rs 50,000) | ✓ | X | ✓ |

| Entertainment Allowance Deduction and Professional Tax | ✓ | X | X |

| Perquisites for official purposes | ✓ | ✓ | ✓ |

| Interest on Home Loan u/s 24b on slef-occupied or vacant property | ✓ | X | X |

| Interest on Home Loan u/s 24b on let-out property | ✓ | ✓ | ✓ |

| Deduction u/s 80C (EPF|LIC|ELSS|PPF|FD|Children’s tuition fee etc) | ✓ | X | X |

| Employee’s (own) contribution to NPS | ✓ | X | X |

| Employer’s contribution to NPS | ✓ | ✓ | ✓ |

| Medical insurance premium – 80D | ✓ | X | X |

| Disabled Individual – 80U | ✓ | X | X |

| Interest on education loan – 80E | ✓ | X | X |

| Interest on Electric vehicle loan – 80EEB | ✓ | X | X |

| Donation to Political party/trust etc – 80G | ✓ | X | X |

| Savings Bank Interest u/s 80TTA and 80TTB | ✓ | X | X |

| Other Chapter VI-A deductions | ✓ | X | X |

| All contributions to Agniveer Corpus Fund – 80CCH | ✓ | Did not exist | ✓ |

| Deduction on Family Pension Income | ✓ | ✓ | ✓ |

| Gifts up to Rs 50,000 | ✓ | ✓ | ✓ |

| Exemption on voluntary retirement 10(10C) | ✓ | ✓ | ✓ |

| Exemption on gratuity u/s 10(10) | ✓ | ✓ | ✓ |

| Exemption on Leave encashment u/s 10(10AA) | ✓ | ✓ | ✓ |

| Daily Allowance | ✓ | ✓ | ✓ |

| Transport Allowance for a specially-abled person | ✓ | ✓ | ✓ |

| Conveyance Allowance | ✓ | ✓ | ✓ |

EXEMPTIONS ALLOWABLE UNDER NEW TAX REGIME:-

i) Interest and final payment under PPF [u/s 10(11)]

ii) Interest and final payment under Sukanya Samriddh Yojna [u/s 10(11A)]

iii) Sum received from Life Insurance Policy [10(10D)] – New Policy after 01-04-2023 limit upto 5 Lakhs annual premium

iv) Payments including withdrawals from NPS [u/s 10(12A)/(12B)]

v) Gratuity [u/s 10(10)], Commutation of Pension [u/s 10(10A)], Leave Encashment [u/s 10(10AA)],

Retrenchment Compensation [u/s 10(10B)], Compensation on Voluntary Retirement or Separation

[u/s 10(10C)], Non Monetary Perquisite by Employer [u/s 10(10CC)], Interest and Withdrawal

from Recognised Provident Fund [u/s 10(12)], Payment from approved Superannuation Fund

[u/s 10(13)]

vi) Alternate Minimum Alternate Tax u/s 115JC is not applicable in case of Lower Tax Regime.

KSS PRASAD INCOME TAX SOFTWARE FY 2023-24 AY 2024-25 LATEST VERSION 2024 DOWNLOAD click here

BLOCKED DEDUCTIONS/ INCENTIVES IN NEW TAX REGIME:-

i) Leave Travel Concession [u/s 10(5)]

ii) House Rent Allowance [u/s 10(13A)]

iii) Special Allowance other than those as may be prescribed [u/s 10(14)]

iv) Allowances to MP/ MLAs [u/s 10(17)]

v) Exemption of Rs. 1500/- for clubbed income of minor child [u/s 10(32)]

vi) Special Economic Zone [u/s 10AA]

vii) Entertainment Allowance Deduction [u/s 16(ii)]

viii) Professional Tax Deduction [u/s 16(iii)]

ix) No Adjustment of Losses brought forward from earlier years and/or Additional Depreciation of

earlier years is permitted.

x) No adjustment for depreciated value of block of assets brought forward is permitted.

xi) Loss on account of Interest on Home Loan [u/s 24(b)]

xii) Additional Depreciation [u/s 32(1)(iia)]

xiii) Investment Allowance in case of Backward Area [u/s 32AD]

xiv) Tea/ Coffee/ Rubber Development Accunt [u/s 33AB]

xv) Site Restoration Fund [u/s 33ABA]

xvi) Deduction for Scientific Research [u/s 35(1) (ii)/(iia)/(iii), 35(2AA)]

xvii) Capital Expenditure pertaining to Specified Business [u/s 35AD]

xviii) Agricultural Extension Project [u/s 35CCC]

xix) Deduction u/s 80C to 80U [except Employers Contribution to NPS u/s 80CCD(2),

Agniveer Corpus Fund u/s 80CCH, deduction u/s 80JJA and 80LA(1A)]

xx) No Adjustment of Losses brought forward from earlier years and/or Additional Depreciation of

earlier years is permitted.

xxi) No adjustment for depreciated value of block of assets brought forward is permitted.

KSS PRASAD INCOME TAX SOFTWARE FY 2023-24 AY 2024-25 LATEST VERSION 2024 DOWNLOAD click here

Five major announcements to make in this regard. These primarily benefit our hard-working middle class

The first one concerns rebate. Currently, those with income up to ` 5 lakh do not pay any income tax in both old and new tax regimes. I propose to increase the rebate limit to ` 7 lakh in the new tax regime. Thus, persons in the new tax regime, with income up to ` 7 lakh will not have to pay any tax.

The

second proposal relates to middle-class individuals. I had introduced,

in the year 2020, the new personal income tax regime with six income

slabs starting from ` 2.5 lakh. I propose to change the tax

structure

in this regime by reducing the number of slabs to five and increasing

the tax exemption limit to ` 3 lakh. The new tax rates are:

- No tax will be charged on income up to 3 lakh rupees.

- Income between 3-6 lakh rupees would indeed be taxed at 5%.

- Income between 6 and 9 lakh rupees would indeed be taxed at 10%.

- Income between 9 and 12 lacks at 15%

- Earnings of 12-15 lakh at a 20% tax rate

- Income of 15 lacks or over will also be taxed at 30%.

third

proposal is for the salaried class and the pensioners including family

pensioners, for whom I propose to extend the benefit of standard

deduction to the new tax regime. Each salaried person with an

income of ` 15.5 lakh or more will thus stand to benefit by ` 52,500.

My fourth announcement in personal income tax is regarding the highest tax rate which in our country is 42.74 per cent. This is among the highest in the world. I propose to reduce the highest surcharge rate from 37 per cent to 25 per cent in the new tax regime. This would result in reduction of the maximum tax rate to 39 per cent.

Lastly, the limit of ` 3 lakh for tax exemption on leave encashment on retirement of non-government salaried employees was last fixed in the year 2002, when the highest basic pay in the government was ` 30,000/- pm. In line with the increase in government salaries, I am proposing to increase this limit to ` 25 lakh.

We

are also making the new income tax regime as the default tax regime.

However, citizens will continue to have the option to avail the benefit

of the old tax regime

KSS PRASAD INCOME TAX SOFTWARE FY 2023-24 AY 2024-25 LATEST VERSION 2024 DOWNLOAD click here

RAMANJANEYULU INCOME TAX SOFTWARE FY 2023-24 AY 2024-25 LATEST VERSION 2024 DOWNLOAD CLICK HERE